Your Mortgage, Your Way:

Tailored Solutions for You by Australia’s Leading Mortgage Experts

From feeling overwhelmed to knowing you’re in control!

Here’s a simple plan for getting your home loan approved quickly.

Our Lender Panel

Leveraging enduring relationships with trusted, industry renowned partner lenders.

Plus many more …

Why Choose Lendstreet?

We’ll guide you through the process from start to finish with no jargon and everything explained simply!

We’ll guide you through the process from start to finish with no jargon and everything explained simply!

Get access to over 50 lenders and thousands of home loan products.

Benefit from our personalised approach for your unique lending needs.

Some words from our clients

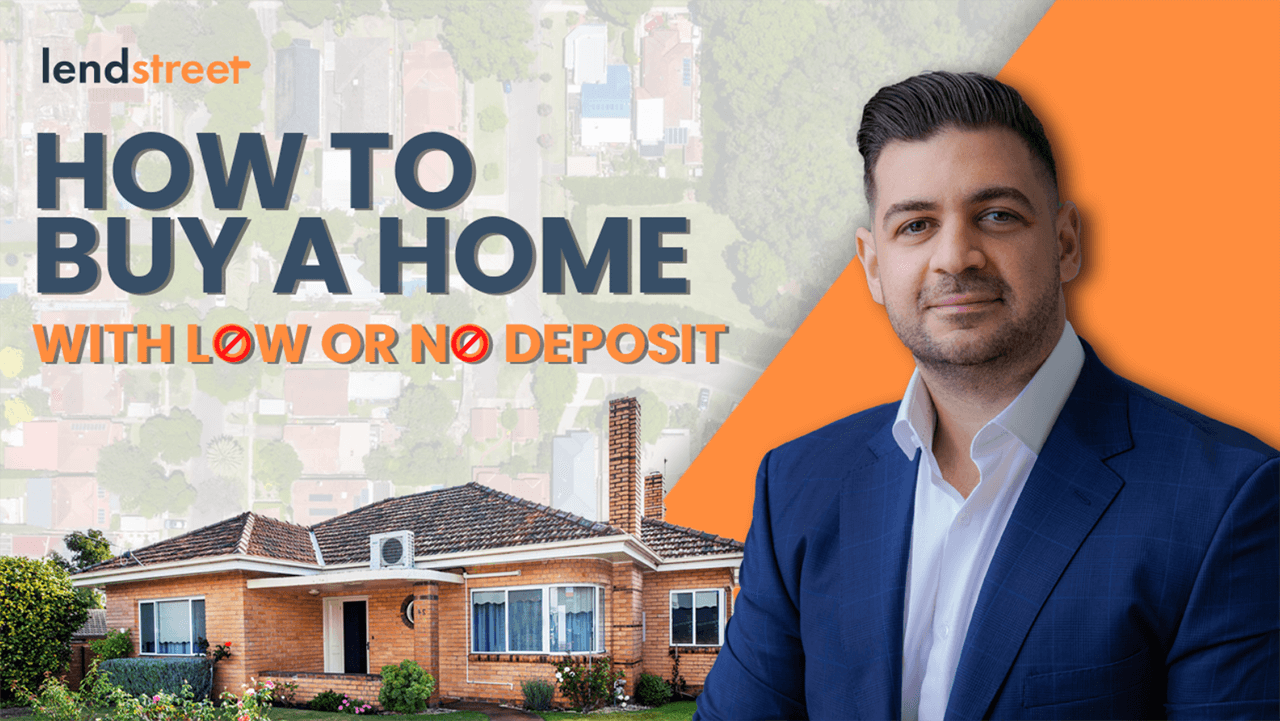

Informative videos to watch from our YouTube channel

Get free home loan advice.

Chat with one of our trusted mortgage brokers without needing to commit. Our initial talk will be to assess your requirements and discover potential options from the market.