In what the NSW government claims to be a historic legislation, a new law was passed in Parliament yesterday, 10 November 2022. This new law will enable first home buyers to choose between paying a smaller property fee or a large upfront stamp duty on their first purchase.

As it currently stands, in NSW, when someone buys a home, they are required by the government to pay tax (stamp duty) for the transfer of ownership of a property from one person to another.

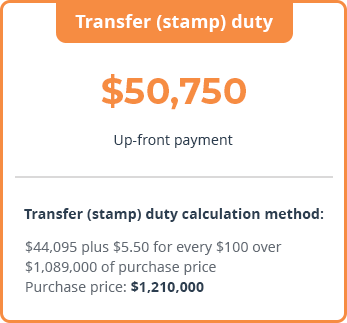

Stamp duty is calculated based on the purchase price. It works on a regular up-and-down scale, meaning that the more expensive the property is, the more the stamp duty charge will be. Know more about stamp duty in NSW or calculate your stamp duty here.

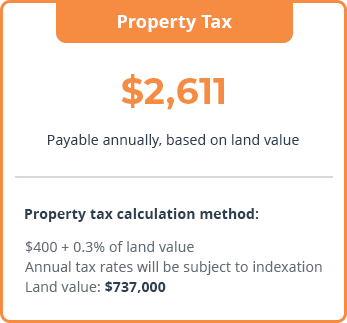

The NSW government recognises that stamp duty is a significant barrier for many first home buyers to enter the property market. Hence, the First Home Buyer Choice was made into law and is applicable for properties under $1.5 million. It applies to any Australian citizen or permanent resident. First home buyers will have the choice to pay an annual levy of $400 plus a 0.3% property tax on the value of their land.

Other features of the NSW First Home Buyer Choice:

- For the purchase of vacant land intended for the construction of a first home, the price cap will be up to $800,000.

- Property tax rates will be indexed so that the average annual property tax payment grows at the same rate as gross state product (GSP) per capita. However, annual property tax increases will be capped at 4% to avoid bill shock.

- This program is uncapped and will be available for eligible first home buyers who want to access it.

Annual Property Tax and Stamp Duty Cost Comparison

Here is a sample computation to illustrate the advantage of opting to pay the annual tax fee versus paying the traditional stamp duty in NSW.

For a Sydney property purchased at $1,210,000, a first home buyer will need to pay $2,611 annually versus $50,750 upfront.

It’s important to note that the property tax is based on the land value, whereas stamp duty is based on the total purchase price of the property.

OR

This means that if that property owner decides to sell the house after 10 years (the median holding period), they have paid a total of $26,110 in annual property tax, which is way lower than the upfront stamp duty fee. This is equivalent to a savings of $24,640! It will take 19 years for the annual tax to breakeven with the stamp duty cost.

When Can First Home Buyers Start Accessing This Scheme

The NSW First Home Buyer Choice annual tax option will be fully operational on 16 January 2023.

However, starting tomorrow, first home buyer choice, is available to everybody who will purchase between Saturday and 15 January will be able to access the scheme. Eligible first home buyers will still be required to pay stamp duty but may apply for a refund.

If you are a first home buyer looking to buy a property in Sydney, the First Home Buyer Choice is your chance to significantly reduce upfront costs involved in buying a property as well as the time you need to save for deposit. You still have the option to pay stamp duty if you prefer, but the annual property tax option is seen as a better and more convenient alternative.

It also appears likely that this scheme may be used in conjunction with the First Home Guarantee. This enables eligible first home buyers to purchase a home with as little as 5% deposit without paying Lenders Mortgage Insurance (LMI), which in combination forms a great incentive for potential first home buyers. This will be confirmed as more information about the First Home Buyer Choice scheme is released.

Expert Help and Advice for First Home Buyers

Work with a trusted mortgage broker near you to secure your first home and help you navigate the NSW First Home Buyer Choice scheme and other government grants you can access. If you want to learn more about buying your first property, we’ve got helpful articles for first-time home buyers like you. Just click this link.

Finally, when you’re ready, you can book a free no-obligation consultation with our senior mortgage broker here.

The annual tax property tax option is an excellent boost for first home buyers to finally make the move towards purchasing their first home. This is indeed a historic law that will benefit thousands of aspiring property owners in NSW. For more questions regarding this program, contact Lendstreet Mortgage Brokers.

Sources:

NSW Government Media Releases and The Sydney Morning Herald.

Related articles

Applying for a home loan isn't a walk in the park for most first home buyers, especially when you're ...

Homeownership is a long, challenging, and expensive road, along which you’ll encounter expenses such as stamp duty, land tax, ...

With the Australian real estate market taking a hit in 2022 thanks to increasing mortgage rates, buying a house ...